The U.S. oil and gas sector remains a high-stakes arena as mid-sized operators navigate a landscape defined by persistent volatility. Commodity prices, shaped by global supply swings and domestic demand shifts, continue to test the resilience of these firms. Add in rising borrowing costs, inflationary pressures, regulatory flux, and geopolitical wildcards, and the instinct might be to batten down the hatches—hoarding cash until clarity emerges. Yet, history proves that the boldest gains come from leaning into uncertainty, not retreating from it. Private credit and non-bank capital, with their agility and tailored structures, are the tools mid-sized operators need to deploy capital expenditures decisively and turn headwinds into opportunities.

The U.S. Energy Landscape: A Call for Action

The domestic energy market teeters between promise and peril. Traditional financing—bank loans and public markets—struggles to keep pace with the sector’s demands. Banks, grappling with their own liquidity constraints, have tightened lending to mid-sized upstream and midstream players. Public markets, meanwhile, remain elusive for firms below the half-billion-dollar revenue mark, weighed down by investor hesitancy and rigorous disclosure requirements. “We’re caught in the middle—too small for Wall Street, too ambitious to stand still,” a COO of an Eagle Ford operator recently noted, summing up the mid-sized bind.

Yet, the upside is undeniable. Distressed assets, from Permian acreage to underutilized midstream infrastructure, pepper the market at discounted valuations, while natural gas demand climbs with expanding LNG export capacity. The challenge? Seizing these openings demands swift access to capital—waiting months for a bank’s approval risks missing the boat entirely. Mid-sized operators need financing that matches the market’s tempo, and that’s where private credit shines.

Private Credit and Non-Bank Capital: The Speed Edge

Private credit and non-bank capital stand out for their ability to move fast when it counts. Unlike traditional banks, bogged down by lengthy approval timelines and restrictive terms, private lenders can fund deals in weeks—or even days. A CFO of a North Dakota firm recently shared, “We needed cash for a Bakken recompletion; non-bank capital had us ready in under three weeks.” Secured Research consistently finds private credit outpacing bank funding timelines by a wide margin, a gap that’s only grown amid ongoing economic shifts.

This speed translates to real advantage. Picture a mid-sized operator targeting a pipeline upgrade in the Marcellus. With non-bank capital, capex deployed months ahead of competitors could secure contracts and boost throughput significantly—critical in a market where price swings can upend margins overnight.

Flexibility to Tackle Uncertainty

Beyond pace, these financing tools offer unmatched adaptability. Private credit might roll out as a unitranche loan, blending debt tiers to ease covenant burdens, or as a royalty deal tied to production rather than rigid repayment schedules—perfect for volatile plays like the Haynesville. “We landed a facility with terms that flex with our revenue, not against it,” said a Gulf Coast midstream CEO. Secured Research data highlights a surge in such customized structures, far outstripping the rigidity of bank loans.

This flexibility empowers operators to push forward despite uncertainty. Rising rates? Private credit’s premium is a small price compared to diluting equity. Regulatory shifts? Non-bank funds can back transitional projects like carbon capture or LNG expansions. “The headwinds weed out the timid—those who invest now will dominate later,” a Permian CFO observed.

The Breakthrough Moment

Investing amid volatility isn’t a gamble—it’s a calculated strike. Secured Research modeling shows mid-sized operators using private credit for capex consistently outperform peers tethered to traditional debt, thanks to faster execution. A multi-well pad funded and drilled ahead of schedule could reshape a firm’s market standing—gains that echo long after the initial outlay.

The takeaway for mid-sized operators is stark: hesitation cedes ground. Private credit and non-bank capital unlock the means to act—snapping up assets, scaling output, or innovating through uncertainty. The prize? A front-row seat to the upside while others lag.

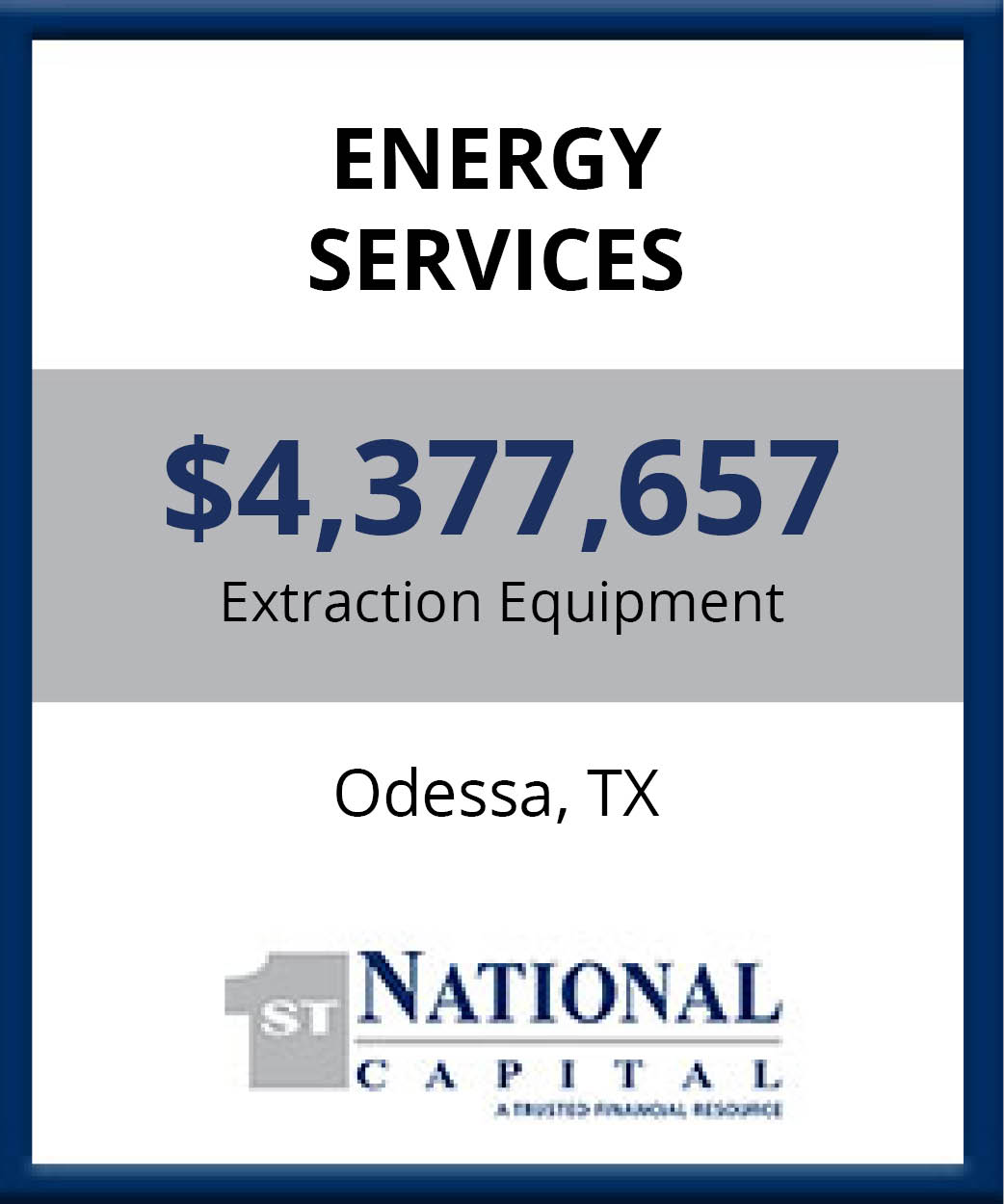

Your Next Step: Partner with Experience

Turning this strategy into action requires a partner steeped in oil and gas know-how. First National Capital (firstncc.com) brings decades of expertise, structuring private credit and non-bank deals through every boom and bust. Their proven approach helps mid-sized operators transform capex into breakthroughs, no matter the market’s mood. Visit firstncc.com to fuel your next move. In an unpredictable world, the bold don’t just endure—they excel.