In an industry where capital fuels every move, mid-sized oil and gas operators face a relentless challenge: securing funds to sustain operations, chase growth, and adapt to a market that refuses to sit still. Commodity prices gyrate with global forces, while traditional financing—bank loans and public offerings—strains under the weight of today’s volatility. Enter private credit: a dynamic alternative that’s rewriting the playbook with its speed, flexibility, and custom-fit solutions. For CEOs and CFOs, mastering this tool isn’t just smart—it’s essential to thriving amid ongoing uncertainty.

The Limits of the Old Guard

Traditional financing once powered oil and gas capex, but its cracks are showing. Bank loans, saddled with tight covenants and drawn-out processes, clash with the sector’s boom-bust cash flows. Secured Research has documented persistent delays in bank funding for mid-sized drilling and midstream projects, eroding the ability to strike while opportunities are hot. Public markets, meanwhile, demand a scale and spotlight that smaller operators—say, a $350MM upstream firm—can’t easily shoulder. “Equity feels like trading the future for a lifeline,” a Permian CFO recently remarked, underscoring the dilution trap.

Private credit flips this script. Fueled by non-bank lenders—think debt funds and specialty financiers—it’s gained traction as bank liquidity tightens and volatility persists. Secured Research notes a steady rise in its use across the energy sector, a testament to its fit for these turbulent times.

The Private Credit Edge

What makes private credit stand out? Speed tops the list. While banks dawdle in red tape, private lenders close deals in a fraction of the time. “We needed funds for a midstream push—private credit delivered in weeks, not quarters,” a Gulf Coast COO recalled. This agility is a lifeline for grabbing distressed assets or ramping production during fleeting price spikes.

Next, flexibility. Private credit bends where traditional loans break, offering structures like delayed-draw loans or revenue-tied repayments that sync with the industry’s ups and downs. Secured Research highlights a growing share of these deals featuring bespoke terms—rare in the bank world. For an operator, this could mean holding off payments until a new well flows, keeping cash free when it’s needed most.

Finally, freedom. With lighter covenants, private lenders focus on cash flow over rigid asset rules, letting operators shift gears—say, from a stalled project to a high-return play—without tripping alarms. “They’re less about control, more about growth,” a $350MM upstream CEO noted.

Weighing the Costs

Critics point to private credit’s higher rates, but the math often tilts in its favor. The real cost of waiting—or watering down ownership—outweighs the premium. Secured Research models show capex funded through private credit, deployed faster, can lift returns significantly by hitting production sooner. In a sector where timing is everything, that’s a decisive win.

A Strategic Play

Private credit isn’t a fallback—it’s a growth engine. Whether it’s a Permian well pad, a midstream overhaul, or a cash flow bridge in choppy markets, it delivers where tradition stumbles. Firms leaning on it consistently boost output post-investment, per Secured Research, outpacing peers stuck in conventional ruts.

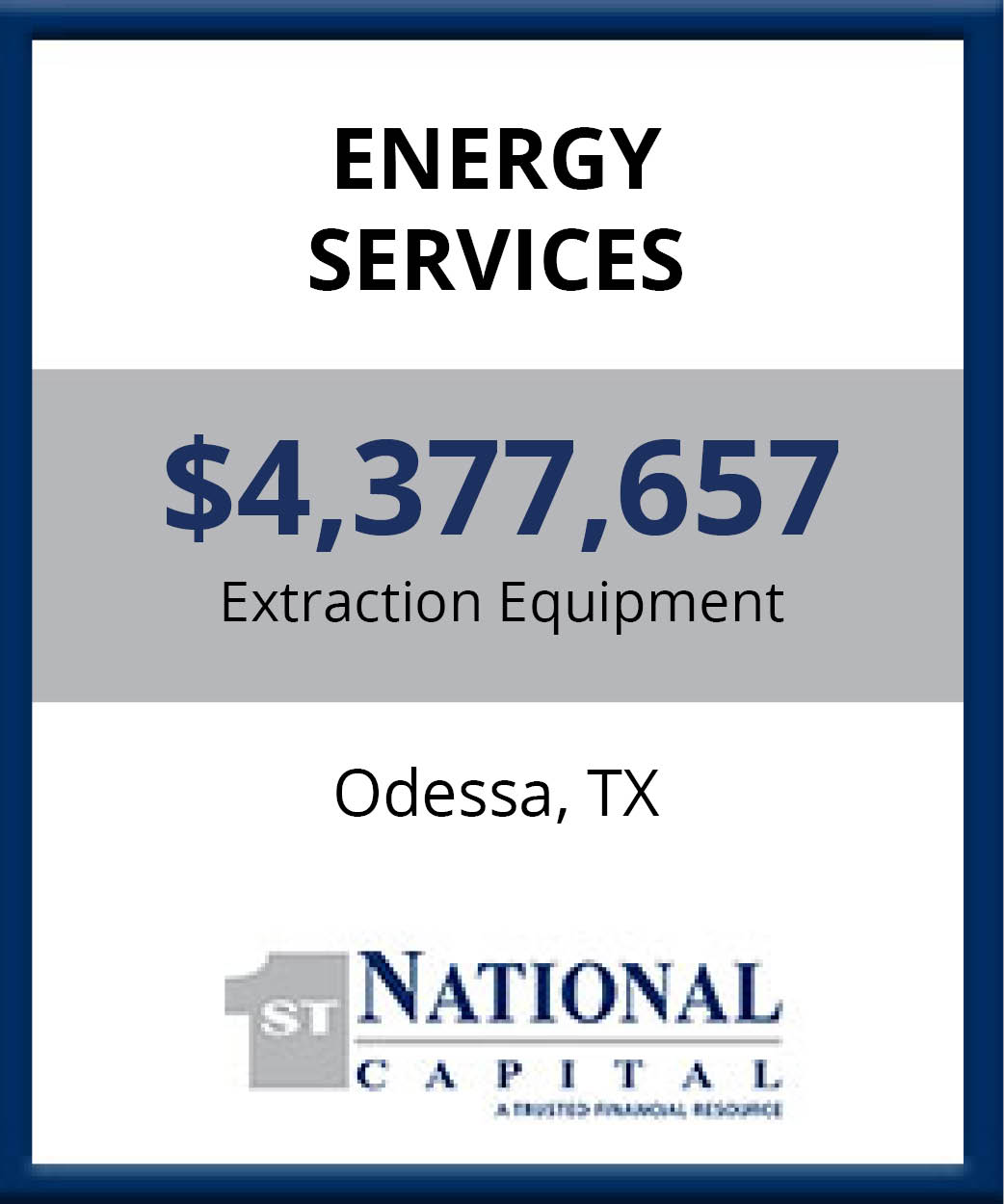

The task for operators is clear: harness this tool with precision. That’s where First National Capital (firstncc.com) steps in. With a track record forged through decades of energy cycles—from the 2008 crash to the 2020 plunge—they craft financing that fits the industry’s pulse. Their energy expertise makes them a natural ally for leaders ready to break free of old constraints.

Act Now

Mid-sized operators can’t bank on calm waters ahead. Private credit offers the means to fund capex today, tailored to the sector’s realities. Reach out to First National Capital at firstncc.com to tap their battle-tested solutions. In a game where agility defines the winners, private credit is the sharpest tool—and the right partner makes it unstoppable.