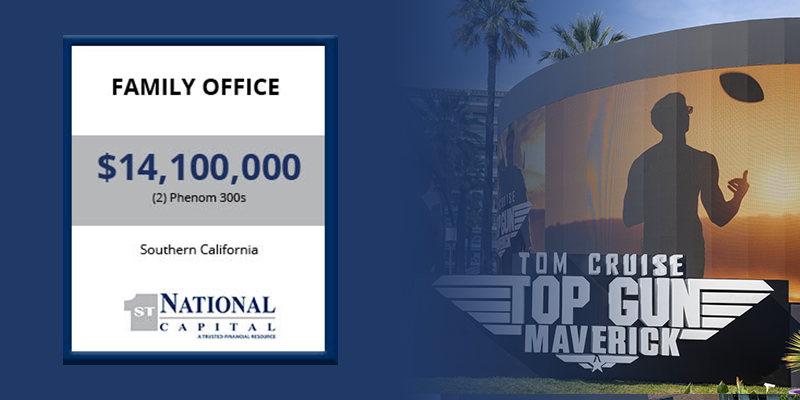

The Customer

Family Office

The Challenge

- The company requested cash out for year-end balance sheet treatment.

- There were two Phenom 300’s that needed to be refinanced. One was a cash out deal and the second had a balloon coming due.

- One of the Phenom 300’s is a specialized aircraft and it’s utilization is in aerial sequences for featured films including the movie “Top Gun Maverick.”

- Filming acrobatic runs, dog fights, low-level, and high-energy flight scenes.

- The camera equipment inside and outside the cockpit was a crucial part of getting this airplane approved and funded. Not an easy task for any lender.

Done Deal.

- This transaction was referred to me by one Family office to another family office.

- We felt comfortable immediately, knowing the family office had two high net worth individuals backing the transaction.

- After issuing the term sheet on the (2) Phenom 300’s, we were referred to an equipment transaction for $1.0M from another one of the family office businesses.

- First National approved the $1.0M equipment line on their balance sheet for GPS tracking devices. Which is not the most fungible equipment assets.

- The company was pre revenue, but FNC was comfortable with the relationship with the Family office so we funded the deal.

- We feel the Customers will continue utilizing FNC’s capital to grow their business.

Business Cycle Volatility

Wider credit appetite for companies in all phases of the business cycle.